- Fraud HQ

- Posts

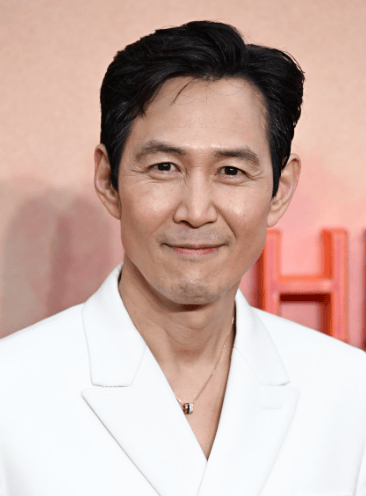

- Romance Scammer Uses Squid Game Star's Image for Scams

Romance Scammer Uses Squid Game Star's Image for Scams

A Detective’s Perspective on Fraud and Scams

“It’s not who I am underneath, but what I do that defines me” — Batman

Every day, scams evolve. They adapt, manipulate, and target those who trust easily or simply don’t know the warning signs. That’s why our work on educating, investigating, and protecting, matters more than ever. We’re not just observers of fraud; we’re the guardians standing between criminals and the vulnerable. Together, we can make it harder for scammers to win and easier for victims to find hope. Because if we don’t take that stand… who will?

Hero Briefing

Woman Loses $350K to Fake “Squid Game” Star

Myanmar Scam Empire! Death Sentences

Former Atlanta Hawks Exec Charged in $3.8M Embezzlement

Crypto ATMs Under Fire: Regulators Say the Model Rewards Fraud

Teen Recruited For China-based International Scam Enterprise

Woman Loses $350K to Fake “Squid Game” Star

The Intel:

A South Korean woman lost $350,000 USD after falling victim to an AI-powered romance scam that used deepfake images and videos to impersonate Squid Game actor Lee Jung-jae.

Over a period of six months, the scammers convinced her she was in a relationship with the celebrity using AI-generated media, fake IDs, and sweet talk to build trust and extract money. The fraudsters even provided a forged driver’s license and used affectionate nicknames like “sweetie” and “honey.”

Authorities believe this was part of a larger scam ring operating out of Cambodia.

Why it matters:

AI deepfakes are no longer science fiction. They’re being used in real-world romance scams. Scammers are weaponizing celebrity trust to manipulate emotions and steal money.

Victims are often emotionally isolated (usually after divorce or being widowed) and AI makes the deception feel real.

Similar scams have impersonated Keanu Reeves, Brad Pitt, Jason Momoa, and Kevin Costner.

Detective’s Insights:

Deepfakes + romance = a powerful psychological trap

These scams rely on emotional manipulation over time. Weeks, months or even years of grooming

The use of fake documents, deepfake videos, and AI chatbots makes scams feel legitimate

Scammers frequently claim to be celebrities or public figures stuck in “secret situations”

Once trust is earned, they request money discreetly or urgently

Takeaway:

How to Spot a Deepfake Romance Scam

✅ Pause: If a public figure suddenly messages you privately, question the reality

✅ Think: Would a celebrity really need your help with money or secrecy?

✅ Verify: Use official channels, reverse image searches such as Tineye.com and Pimeyes.com, and speak to friends or experts

✅ Red Flags: Requests for crypto, gift cards, wire transfers, or moving the chat to private apps like Whatsapp or Telegram

✅ Report and block: Don’t engage, and always report to local authorities or platforms

Myanmar Scam Empire: Death Sentences, Torture, and a Billion Dollar Global Industry

The Intel:

China has sentenced five individuals to death for their roles in a violent fraud and trafficking gang operating out of Myanmar’s Kokang region, where sprawling scam compounds have become global hubs for romance, business, and cybercrime schemes.

These criminal networks have trafficked thousands, many from China, Southeast Asia, and Africa, into forced labor, where victims are tortured and coerced to scam unsuspecting people online. Others joined willingly, lured by promises of high pay. Some were electroshocked and beaten if they failed to meet fraud quotas.

Why it matters:

41 scam compounds were built by this gang alone. Activities included telecom fraud, gambling, homicide, prostitution, and human trafficking.

The UN estimates these global scam centers involve hundreds of thousands of workers and generate billions in profits annually. Centers like KK Park have expanded across Asia, Africa, and even South America and Europe.

Detective’s Insights:

These scams aren’t just online cons. They’re driven by criminal syndicates, traffickers, and militia-backed networks

Victims are often recruited through job ads (often on social media sites) promising tech roles, only to be forced into scam labor

Most scams involve romance bait, investment traps, and cryptocurrency payments

Scam compounds = modern digital sweatshops, complete with 18-hour shifts, torture, and ransom demands for “rescue”

Governments are beginning to repatriate trafficked citizens, but many remain stuck or silent out of fear

Takeaway:

What to Watch For

✅ Beware of high-return investment offers or love interests asking for money

✅ Pause.Think.Verify before sending cryptocurrency, especially via Crypto ATMs

✅ If you suspect someone may be trafficked into a scam center, report it immediately

✅ Law enforcement, banks, and nonprofits must start treating scam labor like organized crime & trafficking, not “just fraud”

Former Atlanta Hawks Exec Charged in $3.8M Embezzlement Scheme

The Intel:

Lester Jones, former Senior VP of Financial Planning and Analysis for the Atlanta Hawks, has been federally indicted for allegedly embezzling $3.8 million from the team using fraudulent corporate credit card charges.

According to the U.S. Attorney’s Office, Jones abused his control over the Hawks’ American Express account, issuing himself multiple corporate cards, and disguising personal luxury expenses including international trips, a Porsche, and concert tickets, as legitimate team business.

Lester used team credit cards to book luxury travel to the Bahamas, Thailand, Switzerland, and more. He later submitted altered bills and emails to the accounting department to conceal personal expenses.

He falsely claimed a $229,968.76 hotel bill at the Wynn Las Vegas was for the Hawks' NBA Cup stay and manipulated internal documents to fabricate approvals.

Why it matters:

This case shows how even top-level financial professionals can abuse access and oversight.

Internal controls failed to catch years of fraud until an audit revealed the truth.

Corporate card abuse is one of the most common forms of occupational fraud in major organizations.

Detective’s Insights:

Embezzlers often start small, test the system, and scale up when they feel emboldened

Access + authority = high fraud risk. Even executives must be audited regularly

Red flags include:

Unusual travel patterns

Inflated expenses without matching receipts

One person controlling multiple financial workflows

This is a textbook case of a “trusted insider” gone rogue — a key focus area for any anti-fraud program

Takeaway:

Enforce separation of duties in finance workflows

Monitor corporate card usage with automated alerts for high-risk transactions

Require original receipts and verify them with vendors when needed

Train staff to spot red flags and escalate suspicious behavior

Crypto ATMs Under Fire: Regulators Say the Model Rewards Fraud

The Intel:

State attorneys general and federal lawmakers are ramping up pressure on crypto ATM operators amid mounting evidence that scammers are exploiting the machines to steal hundreds of millions from vulnerable users.

Investigations revealed that up to 93% of transactions at some kiosks were linked to scams, often targeting the elderly and resulting in devastating losses. High fees, poor customer support, and willful ignorance of red flags appear to be built into the business model, prompting growing calls for accountability and regulation.

Why it matters:

The FBI estimates $240 million in losses to crypto ATM fraud in just the first half of 2025. Victims are often older adults, coerced into depositing life savings into kiosks controlled by scammers.

Despite internal red flags, some crypto ATM companies simply ask for a new wallet address when scams are detected. The industry’s sky-high fees (12%–30%) make it profitable for operators to look the other way.

Regulators are not trying to kill crypto. They’re demanding companies protect the public.

Detective’s Insight:

Crypto ATMs have become fraud funnels, especially in romance scams, police impersonation, and tech support hoaxes.

A 71-year-old victim used 205 wallet addresses, sending nearly $300,000 before one company finally intervened.

Store clerks are trying to warn victims but lack training and support from ATM operators.

Companies deflect responsibility by pushing victims to call police, even though the kiosks are physically controlled by the companies.

A deputy in Texas literally sawed open a kiosk to save a victim’s cash before it was lost — a powerful symbol of desperation and system failure.

Takeaway:

If you're told to deposit money into a Crypto/Bitcoin ATM, it's a scam — no bank, police, or tech company operates this way.

Crypto ATM scams disproportionately affect senior citizens, who trust physical machines and may not be tech-savvy.

Crypto ATM companies must:

Be fully transparent about real fees.

Slow down suspicious or high-dollar transactions.

Flag and block suspicious wallet addresses instead of allowing easy workarounds.

Regulation isn't killing crypto. It’s saving it from itself by cleaning up predatory behavior.

Teen Recruited For China-based International Scam Enterprise

The Intel:

A young man from St. Louis, Jiancheng Chen, was sentenced to two years in prison for laundering over $2.6 million for a China-based criminal enterprise targeting elderly Americans through tech support and romance scams.

Recruited at age 17, Chen served as a money mule, facilitating the flow of stolen funds from victims in St. Charles County and beyond. While he expressed remorse in court and hoped to expose higher-level operatives, the life savings of numerous victims had already been lost.

Why it matters:

This case exposes how transnational crime rings exploit vulnerable seniors using local money mules, often young and manipulated themselves. Elder fraud isn't slowing down as local officials say two new cases of incapacitated victims arise each week in St. Louis County alone.

One of the victims lost $1 million on a fake home renovation project. This story that mirrors countless others across the country. The scammers use emotional manipulation and fake tech alerts to isolate and control victims, draining their accounts before families can intervene.

Criminal enterprises in China and Southeast Asia are strategically targeting U.S. communities by deploying mules on the ground.

Detective Insights:

Money mules are critical nodes in international fraud networks — without them, the scam grinds to a halt.

Young people are often groomed into these roles using false promises, loyalty, or fear, sometimes, before they even graduate high school.

The human cost is immense. Victims aren’t just losing money, they’re losing independence, homes, and dignity.

Chen’s remorse highlights a hidden reality: even low-level players often regret their involvement when they see the consequences.

Takeaway:

If you see a tech support warning or pop-up — NEVER CALL THE NUMBER.

Elderly loved ones are prime targets. Check in often and help them verify suspicious calls or messages.

Mules like Chen might be young, but they enable serious financial crimes and the legal consequences are real.

Communities need early intervention systems to detect when elders are being exploited.

These crimes are not isolated. They're part of a highly coordinated global scam infrastructure.

Introducing the Crypto ATM Codex

Fraud Hero’s Crypto ATM Codex is your go-to directory for navigating one of today’s fastest-growing scam tools, cryptocurrency ATMs. This evolving resource gives victims and investigators a centralized place to find contact information for crypto ATM operators, including phone numbers, emails, and reporting links. Many states now require victims to file a report directly with the operator to qualify for restitution, yet few people know where to begin. The Codex bridges that gap.

As it grows, it will include state-by-state laws, upcoming legislative changes, and updates on how these machines are being exploited by scammers. With crypto ATM-related losses projected to reach half a billion dollars this year, knowledge and quick reporting are critical. The Crypto ATM Codex was built to make that possible.