- Fraud HQ

- Posts

- NFL Player Loses $240K From Bank Imposter Scam

NFL Player Loses $240K From Bank Imposter Scam

A Detective’s Perspective on Fraud and Scams

Hello Everyone! It’s Marc, your neighborhood Fraud Hero! I want to welcome you to the very first edition of Fraud HQ.

This won’t be a newsletter that only provides stories about the latest fraud and scams.

Here’s what I’m going to provide you with this newsletter:

True insight into how these scams work

Real world advice on how to prevent and fight against these scams

What makes this different?

I have seen the pain caused by criminals, firsthand. I have interviewed the suspects, face to face. I have dealt with the banks and businesses. And I see what happens in the courtrooms after the arrest. I’m bringing you a holistic view of fraud and scams.

To be a true hero, you have to be willing to face every challenge head on.

Suit up Fraud Heroes! Let’s go save the world, one story at a time.

Hero Briefing

NFL Player loses $240K to Imposter Scam

USPS Employees Steal $80M Worth of U.S Treasury Checks

“Ghost Students” Receive Federal Student Aid

A.I Deepfake Sextortion Scam Costs Teen His Life

Theft or Recovery? Should Police Be Allowed To Remove Money From A Bitcoin ATM?

Minnesota Vikings player loses $240K to bank imposter scam

The Intel:

Minnesota Vikings linebacker Dallas Turner was allegedly scammed out of $240,000 after receiving a call from someone posing as a JPMorgan Chase banker.

The caller claimed someone was impersonating Turner at a bank branch and convinced him to transfer money to two businesses to “protect” his funds.

Turner later realized he may have been defrauded and reported the incident to police. Only $2,500 has been recovered so far.

Why it matters:

This case shows how even high-profile individuals can fall victim to social engineering scams.

The impersonator used fear, urgency, and fake authority to trick Turner into wiring massive amounts of money. These tactics are used every day against regular citizens.

With financial institutions now under scrutiny in this case, it raises broader questions about internal controls, employee involvement, and the need for widespread fraud awareness.

Detective’s Insights:

The scammer pretended to be a bank employee, exploiting trust and urgency to manipulate the victim.

He is a public figure, which means his personal information may be easier to obtain than most others.

Two different business accounts were used, likely money mule accounts set up to launder and quickly disperse the stolen funds.

The scam used real-sounding threats, like identity impersonation and wire fraud, to legitimize the story.

Turner only realized the fraud after consulting a family member, showing how important second opinions can be.

Police are investigating potential insider involvement at the bank, which is rare but possible in high-dollar fraud cases.

Note: A money mule is a person who transfers or moves stolen money on behalf of criminals, often unknowingly, to help launder the proceeds of fraud.

USPS Employees Steal $80M Worth of U.S Treasury Checks

The Intel:

Two USPS workers and their accomplices were charged in a massive scheme to steal and sell U.S. Treasury checks.

Thousands of checks were taken from a Philadelphia postal facility and resold on Telegram.

Over $11 million was successfully cashed, part of a staggering $80 million in stolen government funds.

Why it matters:

This case exposes serious weaknesses inside the U.S. Postal Service and the threat of insider fraud.

Government checks are lifelines and victims often don’t realize theirs were stolen until they never arrive.

A new Treasury Check verification system is on the way, but with physical Treasury checks being phased out, it may be too little too late.

Detective’s Insights:

Insider access is the first breach. Employees used their USPS roles to steal undelivered government checks. USPS and USPIS need a better working relationship.

Mail theft remains one of the biggest enablers of large-scale identity theft and financial fraud. It’s easy and often overlooked.

Telegram is the go-to marketplace for selling stolen checks, full identities, and fraud templates.

Checks are sold and sent out everywhere, which makes it difficult to pinpoint exactly who the seller is.

This case involved multiple agencies, showing how complex and widespread the impact was.

“Ghost Students” Receive Federal Student Aid

The Intel:

Scammers are creating “ghost students” using stolen identities to steal financial aid.

They use AI-generated videos and voices to pass ID checks, enroll in online classes, and vanish once the money is disbursed.

Victims are left with debt, damaged credit, and no idea how it happened.

Why it matters:

This scam isn’t just about stealing financial aid. It’s about stealing identities and ruining lives.

AI deepfakes and bots make the fraud harder to detect, while victims are left with debt and damaged credit.

Students and parents must stay alert. Fake FAFSA reps and bogus enrollments can leave lasting financial scars.

Detective’s Insights:

AI-generated videos and voices are used to pass ID checks, making it hard for schools to detect impostors.

Bots enroll in online classes, doing just enough work to avoid raising suspicion until aid is disbursed.

Victims may face ruined credit, which can impact their ability to rent housing, buy a car, or secure loans.

Young adults could begin adulthood with fraudulent debt, affecting scholarships, internships, or future education plans.

Even those not applying for aid can be targeted, simply because their personal data was compromised elsewhere.

A.I. Deepfake Sextortion Scam Costs Teen His Life

The Intel:

He was a happy, well-loved teenager whose life was tragically cut short after receiving a threatening text.

The scammers sent an AI-generated nude image of him, demanding $3,000 or they’d share it with his friends and family.

Overwhelmed by fear and shame, he died by suicide shortly after receiving the message.

Why it matters:

This heartbreaking case shows how dangerous sextortion has become in the age of AI.

Scammers no longer need real images. They can create fake ones to extort and emotionally destroy their victims.

Many parents and teens don’t even know this kind of crime exists until it’s too late.

Detective’s Insight:

Scammers target teens on social media, posing as peers or romantic interests before turning on them. Boys are targeted much more often than girls.

Once they’ve created enough fear, they demand payment through CashApp, Apple Pay, Zelle, and Venmo.

Victims feel isolated, ashamed, and scared, believing there’s no way out. This makes is hard for investigators to get the truth from the victims.

Parents often find out too late, because kids are too afraid or embarrassed to tell them.

These groups are organized, well-funded, and global, making prevention, not just prosecution, essential.

Theft or Recovery? Should Police Be Allowed To Remove Money Directly From A Bitcoin ATM?

The Intel:

As Bitcoin ATM scams rise, victims are being tricked into depositing thousands of dollars into machines operated by private companies.

Bitcoin Depot acknowledged the emotional impact on victims but stated that once the crypto is sent, the transaction is final.

The officers in Texas, cut open the machine with a saw and seized $32K from the machine which is actually more than what was sent in the scam.

Why it matters:

Once funds are sent through a Bitcoin ATM, victims have little to no recourse for recovery.

These machines are not regulated like banks and offer no fraud protections, even when it’s clearly a scam.

With scammers increasingly relying on this method, the lack of oversight leaves victims exposed and alone.

Detective Insights:

Law enforcement can’t just take back funds from the ATM. I say this as a Detective who has investigated these case. Breaking open the machine is theft from the operator whether you like it or not.

Scammers direct victims to Bitcoin ATMs, coaching them over the phone to deposit cash quickly.

Many victims believe they’re paying law enforcement, the IRS, or a bank fraud department when they deposit the cash.

Rapid reporting is the key to getting these funds back. The faster the victim can provide transactions details, the higher chance law enforcement has to get the money back.

The truth about these operators. Most of the money they make is from scams. So until regulations catch up or they are outright banned, they will continue to be a problem.

Scam Breakdown

Imposter/Impersonation Scams

How they work

Scammers impersonate trusted organizations such as banks, government agencies, law enforcement, or even family members, using phone calls, emails, or text messages to trick victims into sending money or revealing personal information.

Common imposter scams include:

Scammers use psychological manipulation to create fear and urgency, making it harder for victims to think critically. They often pretend to be from trusted companies, using technical jargon to sound legitimate. Recognizing these warning signs early can prevent financial loss and identity theft. Sometimes the scammers have done research using the dark web, data breaches, and data broker websites to know more about you before they contact you.

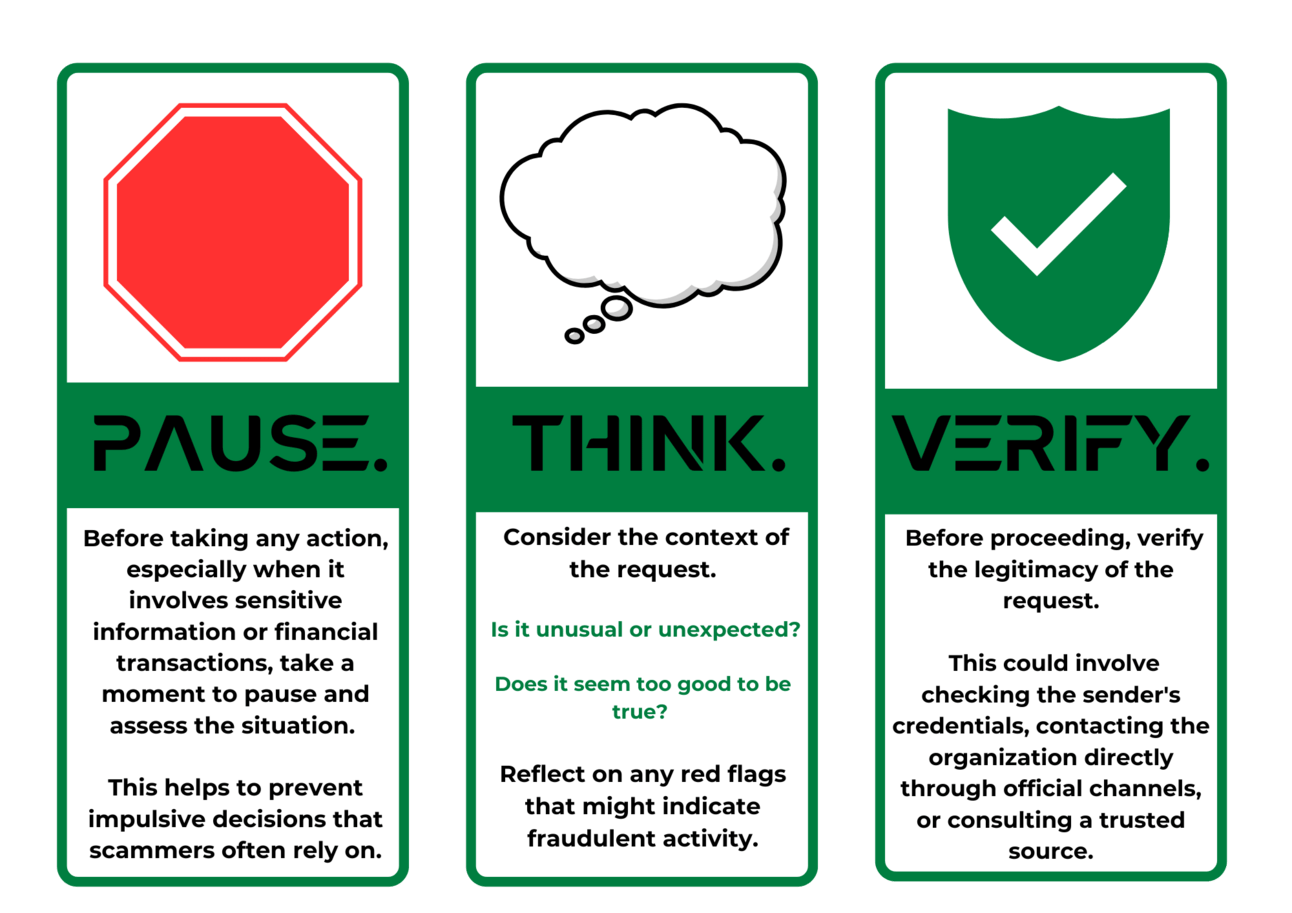

Fraud Prevention Tip of the Week

Scammers are experts at making you panic. They create a sense of urgency. Whether it’s a supposed fraud alert from your bank, a fake IRS call, or a "limited time" investment opportunity. At the very least, if you’re not sure, or something feels “off”, hang up the phone.

By following these three steps, you can avoid making rushed decisions that could cost you money, personal information, or even your identity. Scammers need you to act fast, so do your best to slow down and stay in control.

Fraud By the Numbers

The Federal Trade Commission (FTC) and the Federal Bureau of Investigation (FBI) compile reports each year to provide insights into the fraud and scam landscape. Below is a snapshot from the reports as well as the full reports.

FTC Snapshot - Top Scams

| FBI Snapshot - Top Scams

|