- Fraud HQ

- Posts

- Mr. Beast Takes The Fight To Scammers

Mr. Beast Takes The Fight To Scammers

A Detective’s Perspective on Fraud and Scams

“I choose to run toward my problems, and not away from them. Because that’s what heroes do.” — Thor

Social engineering scams are exploding and they’re smarter, faster, and scarier than ever. We’re seeing a new wave powered by AI voice clones, deepfake videos, and ultra-convincing impersonations.

And here’s the kicker: even celebrities like MrBeast have been impersonated in these scams. If someone with hundreds of millions of followers can be targeted, what does that mean for the rest of us?

For individuals, it means more texts, calls, and DMs that look real. For businesses, it means employees tricked into moving money or handing over access. Bottom line: no one is safe, and the scams are only getting bolder.

Hero Briefing

Entrepreneur Scammed Out of $1.25M by Fake MrBeast Group Chat

DOJ Freezes $868K in Tether Linked to Crypto Scam Syndicate

Crypto Execs Targeted by Deepfake Voice Scams

DC Attorney General Sues Bitcoin ATM Operator for Enabling Scams

U.S. Man Sentenced for Laundering $36.9M from Cambodian Scam Centers

Entrepreneur Scammed Out of $1.25M by Fake MrBeast Group Chat

The Intel:

Even savvy entrepreneurs aren’t safe. Swedish businessman Erik Bergman fell victim to one of the most convincing social engineering scams of the year, losing $1.25 million in cryptocurrency after being lured into a fake WhatsApp group chat full of impersonated celebrities, including MrBeast and Mark Rober.

The scam started with a legitimate $1M donation to MrBeast’s real charity, Team Water. But shortly after, scammers posed as MrBeast’s team, invited Bergman to a private donor group chat, and pitched a fake exclusive crypto coin opportunity. By the time he called the real MrBeast, the money was gone.

Why it matters:

Shows how real events are hijacked to make scams more believable

Criminals used celebrity impersonation + fake group dynamics to build trust

Demonstrates how urgency and flattery are used to bypass logic

Victims aren’t “naive.” They’re often successful, educated, and generous

Detective’s Insights:

Scammers piggybacked on a real donation to build credibility

The fake WhatsApp group simulated banter and community trust

The urgency (“act fast or miss out”) triggered emotional decision-making

Crypto + charity + celebrity = perfect storm for high-dollar scams

This wasn’t just phishing. It was a high-end impersonation scam

Takeaway:

Scammers are watching your posts, donations, and press. The more public your success, the more personalized and professional their traps will be.

DOJ Freezes $868K in Tether Linked to Crypto Scam Syndicate

The Intel:

The U.S. Department of Justice has filed a civil forfeiture complaint to seize $868,247 in Tether (USDT) traced to a series of cryptocurrency romance and investment scams that targeted victims across Hawaii, D.C., Texas, Illinois, and Florida.

At the center of the investigation is the LME Crypto Group, a scam ring that impersonated the London Metal Exchange while luring victims into fake crypto investments through misdirected texts and long-term online relationships. One victim in Hawaii reportedly lost $1.3 million.

The DOJ credits Tether for cooperating in freezing the funds. The underlying scheme relied on fake trading apps, romance-style grooming, staged profits, and exit scams..

Why it matters:

This is a textbook pig butchering crypto scam: slow grooming, fake apps, and manipulated trust.

The DOJ is taking the fight to scammers, and following the money through mixers and wallets.

More than $5.8 billion was lost to crypto investment fraud in 2024 alone and that's just what was reported to IC3. The real number could easily be double.

Detective’s Insights:

The Fraud Formula in action!

1. Hook:

A “wrong number” text that turns into casual conversation or a friendly face on a dating app.

2. Story:

“I made a ton of money using this crypto platform, let me show you.”

Or, “My uncle works at a trading firm, I can get you in.”

3. Urgency:

“You have to act fast before the market shifts.”

“Withdrawals are closing soon. Transfer now if you want in.”

4. Payment:

You’re walked through buying crypto, then shown how to “invest” it in a fake platform.

You see fake profits, feel confident, invest more, then get locked out.

Crypto Execs Targeted by Deepfake Voice Scams

The Intel:

Cybercriminals are recruiting professional voice impersonators to scam senior crypto executives in a wave of high-stakes vishing attacks. According to a new report from GK8, threat actors are paying up to $20,000/month to callers who can impersonate support agents, government officials, or internal staff.

The goal? Use voice cloning, AI-driven calls, and curated data leaks to socially engineer their way into custody systems and private key access, putting millions in crypto at risk. These attacks are not mass phishing. They’re tailored, targeted, and run like a professional industry.

Why it matters:

AI voice and video impersonation are being deployed in real-time

Criminals now prefer quality over quantity, targeting key insiders

The crypto industry is especially vulnerable due to custody infrastructure

Recruitment for vishing roles includes voice tone, gender, accent, and time zone matching for maximum believability

Detective’s Insights:

Vishing 2.0 is Organized Crime.

These aren’t amateurs. They’re fraud call centers with tiered pay and human trafficked victims

The voice calls are driven by stolen executive profiles and leaked credentials

Some actors are using deepfake video for Zoom-style calls or internal onboarding

The tactic mirrors North Korean-style infiltration, where job applicants are faked entirely

Takeaway:

If you're a CTO, CFO, or legal counsel in the crypto space, you’re a target. Don’t rely on single sign-off approvals. Implement transaction verification protocols, multi-person authentication, and mandatory voice/video verification training.

DC Attorney General Sues Bitcoin ATM Operator for Enabling Scams

The Intel:

The Office of the Attorney General for the District of Columbia has filed a lawsuit against Athena Bitcoin, Inc., one of the largest Bitcoin ATM (BTM) operators in the U.S., for knowingly facilitating scams, charging hidden fees, and refusing refunds to elderly victims, even when they report fraud.

According to Athena’s own data:

93% of all BTM deposits were the result of scams

Victims’ median age was 71

Median loss per scam was $8,000

One senior lost $98,000 in 19 transactions

Why it matters:

Athena’s machines, along with many other crypto ATMs, lack fraud safeguards, making them a go-to tool for scammers

The company allegedly profits from 26% undisclosed transaction fees — up to 10x higher than typical exchanges

They enforce a strict “no refunds” policy, even when victims report scams

Victims are asked to sign liability waivers in exchange for partial refunds

This is a rare but critical legal move against a crypto ATM company accused of enabling fraud and profiting from elder exploitation.

Detective’s Insight:

Athena’s own records show nearly nearly all transactions were results of scams

These BTMs are frequently used in romance scams, government imposter scams, law enforcement imposter scams, and tech support scams

Victims were told to deposit money into a scammer’s wallet, not their own

Athena allegedly chose profit over protection, ignoring the red flags

Many of these scams are part of a larger problem involving local and transnational criminal organizations, even including prison gangs

U.S. Man Sentenced for Laundering $36.9M from Cambodian Scam Centers

The Intel:

A California man has been sentenced to over 4 years in federal prison for laundering money from a massive digital asset investment scam run out of Cambodia. Shengsheng He, 39, pleaded guilty to conspiracy charges for helping operate an unlicensed money transmitting business that stole from U.S. investors.

Authorities say U.S. victims were lured into fake crypto investments by scammers posing as romantic partners or friendly investors through unsolicited messages and online dating platforms. The victims’ money was laundered through U.S. shell companies, funneled into offshore bank accounts in the Bahamas, and converted into cryptocurrency (Tether) before landing in wallets controlled by scam operations in Sihanoukville, Cambodia.

In total, the scheme moved over $36.9 million in stolen funds, and the court ordered He to pay nearly $27 million in restitution.

Why it matters:

Victims were targeted through direct messages, fake relationships, and social media outreach

Scammers promoted fraudulent digital asset investments, claiming the money was growing in value

The stolen funds were laundered through Axis Digital, a Bahamas-based company co-founded by He

The scam was global, reaching from California to Cambodia via the Bahamas and multiple crypto wallets

Eight co-conspirators have already pleaded guilty, including high-level foreign nationals and money launderers operating inside the U.S.

This case underscores the global scale of crypto fraud and how it starts with something as simple as replying to a message.

Detective Insights:

These scams don’t start with hacking. They start with hello

Scammers exploit human emotion first (romance, friendship, fake mentorship), then drop the investment pitch

Once money is sent, it’s immediately converted, split, and anonymized through crypto tools and offshore banks

Operations like these use fake companies, fake apps, and real heartbreak

The scale is massive. Hundreds of millions stolen and most victims never recover their funds

Scammers don’t need to break in. They just need you to let them in.

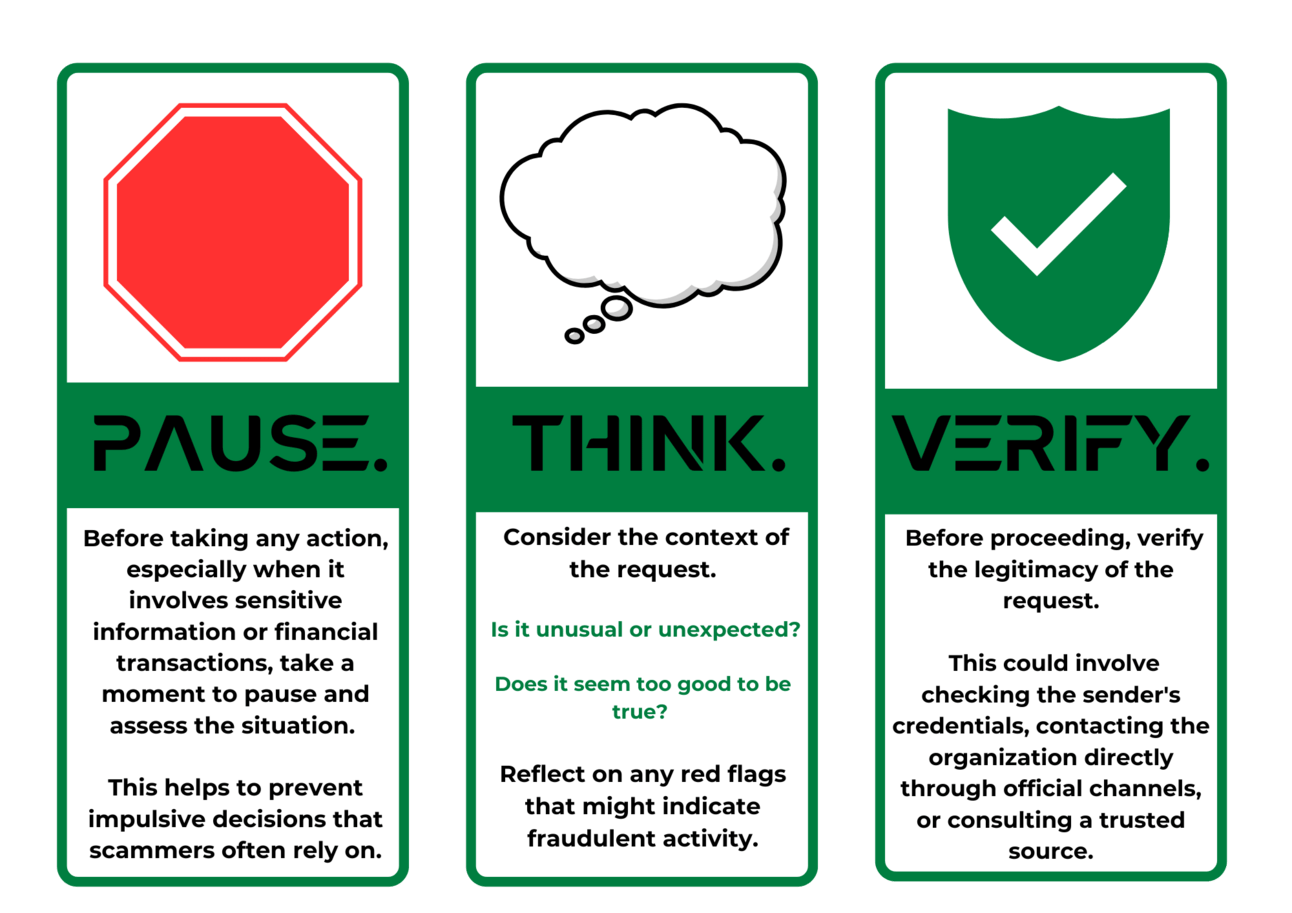

At the end of the day, the most powerful defense against social engineering isn’t technology. It’s awareness. Scammers rely on speed and emotion to trap you, but the Pause, Think, Verify method breaks that cycle. Pause before reacting to pressure. Think about whether the message or request makes sense. Verify through trusted, official channels before taking action.

Whether it’s an everyday consumer or a celebrity being impersonated, the playbook for prevention is the same: slow down, stay skeptical, and confirm before you comply. Stopping scams starts with taking back control of the moment.